Asset rich, Cash poor

Wakey wakey, William Albert Ackman - shill me more hell on CNBC please. The doors to the heavens have been closed shut and crypto whales are publicly admitting their own losses. Someone I have known since 2014 just now (18 Jun) puked a huge chunk of their BTC holdings in the breach of $19k. I, as someone, who was bearish at the stupidity of prices being seen in altcoins is now feeling the glimmer of bottoming hopes; especially if ancient whales are puking all over. The bids side has finally thickened with certain whales like AngeloBTC coming back (at-least) to twitter after their hibernation. The bear memes of the 300 Sparta are slowly making their appearance again and of course we all know what happened to the 300! The slaughter will continue while there are whale wallets with public liquidation prices. The fear of last weekend has abated and instead it's turned into hunger games. Yet - biggest unknowns are the private deals executed off-chain.

If you wish to get a better journalistic look at the mess we created - go here: https://www.axios.com/2022/06/18/ether-bet-gone-wrong-underscores-crypto-winter-drama

As I write there is a Solana "user" in danger of being liquidated - yet sol-degens are trying to defend the price. Liquidation price is $22.27 and current price (at time of writing) is $29.85. The fear is if the $170m SOL gets liquidated then there is a chance of a cascade causing others to be liquidated. Would I bid it? Not a chance - but give me $10 SOL then why not - just for the culture.

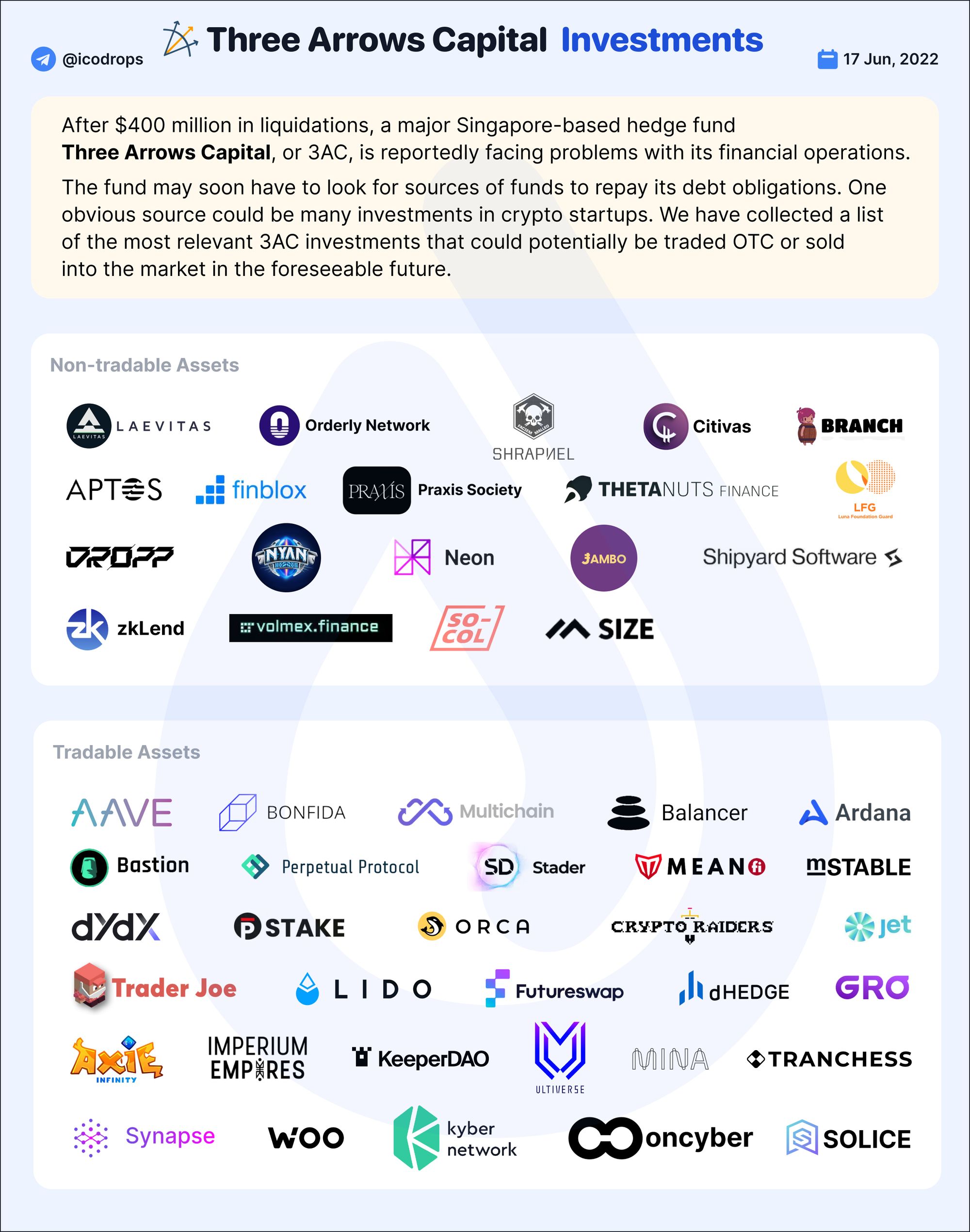

Now the talk of the hour: 3 Arrows Capital. From what I gather their debts are in excess of $2 billion and assets are probably $0.5 billion. However, Su & Kyle of 3AC surely must only be limited partners so there is limited recourse for folks to go after their personal assets which are supposed to be in 100s of millions. Nevertheless, if there was appetite by big bucks out there then am sure SAFTs (https://www.investopedia.com/terms/s/simple-agreement-future-tokens-saft.asp) could be found at distressed prices. Below is someone else's (ICODrops on twitter) hard work on collating all assets 3AC were involved in and which are bound to have distressed valuations as we continue with this drama. For those impacted and wanting to go after Su & Kyle; there are some avenues such as proving misrepresentation or breach of trust or fiduciary etc. To this end, slowly people are coming out of woodworks with information that could help in this area.

Moreover, the target to get Celsius liquidated is now $13k / BTC and some big players on AAVE is $900 / ETH. This long weekend and low liquidity will be best opportunity for anyone who wishes to go for that. At this time I see ETH is $922.

side note:

Celsius attempted to top-up their balance to bring down their liquidation price but instead of paying a higher fee to speedup their transaction they decided to be cheap and the transaction hung around for what I believe was 2 hours before it got picked up!!!! Literally all they had to do was pay a few cents more for the millions they were transferring!! Shows unpreparedness and/or incompetence or both.

Lastly, as with oil rigs vis-a-vis oil prices; soon we probably will start to hear crypto miners defaulting and closing shops. Once the dust has settled I would like to look at cost of joining a mining syndicate - should be much cheaper & affordable finally.

musings:

Folks have forgotten about MTGox distribution - that would be an interesting time with 160k additional supply of BTC hitting markets some time over next couple of years (maybe just before the next bull run?).

ETH merge apparently is coming in September but I fail to verify this in deluge of all the mania. People had staked ETH back when it was $600 for 20% yield and soon we might breach $900!!! What a round trip.

At least I can say its not crypto that failed but central parties like Celsius & degenerate funds following in the footsteps of Bill Hwang and Long Term Capital Management that levered themselves too much and slaughtered everyone & themselves.

As I send this out; ETH just wicked to $883 and BTC $17650...SOL $27.2. Don't worry the whales are not yet liquidated on ETH - battle continues into the night!