amphora

Amphora - the ETH 1 & 2 team event in Greece; has indeed resulted in a functioning dev net and a clear to-do list for the teams involved. Realistic timelines suggest Q2 2022 which I suspect is more-or-less late Q2 given the need to on-board the Ethereum community + rest of the ecosystem (e.g. crypto exchanges, protocol developers).

Bitcoin Futures ETF - great news if true but objectively a spot ETF would be much more fun. Futures based has many tax management, position sizing, margining burdens as far as what I have understood so we'll see. Also, isn't it supposed to be negative carry - so wondering

- who are the buyers generally speaking?

- are dealers hedging with spot or are flat at EOD?

- personally, very much thinking its buy-the-rumour, and sell-the-news but do I wish to fight the Q4 L1 bull-run meme?

- one interesting dynamic to see would be the discount of GBTC

Solana - murmurs about SOL potentially coming out with protocol interoperability enhancements directly with ETH. If it comes out over coming weeks then instead of capital rotating from BTC to ETH might just go directly to SOL first.

While I write; CFTC filed and settled charges with Tether & Bitfinex. $41.0m to be paid by Tether for the stablecoin (USDT) not being fully backed by USD prior to Feb 2019; for comparison that's 0.06% of their holdings. $1.5m to be paid by iFinex (parent company of Bitfinex; the crypto exchange) for running a futures commission merchant (FCM). This should put a stop to the anti-USDT saga which is distracting from the legislative blackhole that needs to be filled with appropriate guidance.

Watch item for next week - MtGox creditor meeting! Potentially another sell-the-news event or the fuel that ignites the bull-run?

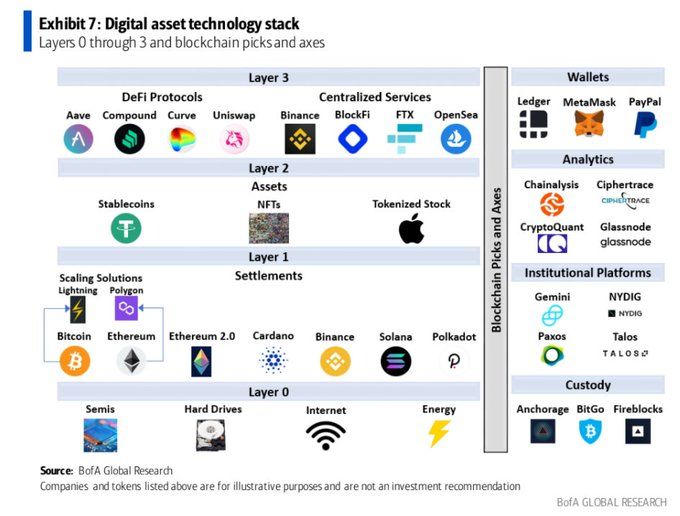

Layer-mania by Bank of America!

LegFi redefining what Layer 0, 1, 2, 3 are for you 🤣 pic.twitter.com/C4q4dDiCyQ

— Emily👁️(CFA,CAIA)Chartered Chain Checker (@AutomataEmily) October 6, 2021

Had a bit of a chuckle at the categorisations / omissions (especially in the graphic above by BofA). Nevertheless, it's a great informative start and very much appreciated.

- Layer 1 - is the base layer of protocol

- Layer 2 - are things that help scale a given protocol in Layer 1 - e.g. Lightning is L2 of Bitcoin; Polygon is L2 of Ethereum

- Stablecoins, NFTs, tokenzied stocks are digital assets that can be launched / traded on top of a protocol (or we can call it platform). These platforms usually exist on layer 2 or 3. So digital assets shouldn't really be represented as L2 herein.

- Moreover, seeing the combination of Ledger/Metamask into same bucket as PayPal led to number of debates but high-level it makes sense - the caveat is that Ledger/Metamask companies cannot block you from accessing your wallet. However, PayPal can and has done over the years. If I was being pedantic on the categories I would create a sub-category within Custody for asset access management since Ledger / Metamask are tools to store (self-custody) your own credentials + interact with your assets.

2022+ thoughts

In order to stay competitive the centralized exchanges will have to begin to leverage DeFi protocols. This means they (centralized exchange) may need to start to either define themselves a KYC oriented interface on top of DeFi protocols or work with said protocols (e.g. Aave/Uniswap/SOL etc) to have such a feature. Potentially 2 tier system could exist - one KYC-ed other fully anonymous. Use KYC tier to exit to fiat; otherwise enjoy the anon metaverse.

DeFi order books most likely will eat away majority of the liquidity that currently exists on centralized exchanges. This means greater need for a CeDeFi (centralized decentralised-finance); essentially imagine Coinbase order flow going through decentralized pipelines. This makes we wonder if we will start to see "dark pools" concepts also coming through - in some aspects certain L2 / L3 already could do this to provide further privacy to institutional players.